Monday, November 3, 2008

First week of trade

Friday, May 16, 2008

Flurry of activity

- Emailed the architect's report off to Hampton landlord, want to show them what might need to be done. K's indentified potential issues with the roof etc

- Corresponded with T the designer to firm up pricing, she responded, so gave her the go ahead

- Faxed the vendor's signed health inspection form for St Kilda off to City of Port Phillip - so we can get a pre-purchase health inspection

- Spoke to the St Kilda vendor's solicitor to get the lease change moving

- Hampton landlord emailed back to say they'll be in touch when back from Sydney

- Round of emails and phone calls with architects and designer to tee up a meeting on Monday at the St Kilda cafe

Thursday, May 15, 2008

Docklands Inspection

Now got full documentation, and we were able to spend a good amount of time looking through and discussing issues with K, including airconditioning etc. They did a good job designing the building, there's a bin wash, deliveries point, garbage room, plus a grease trap already installed.

The EOI needs to include some background on us, business plan and so on - landlord wants to ensure they have the right mix of right people down there.

Wednesday, May 14, 2008

Big News - We Own a Cafe!

Handling Hampton

Tuesday, May 13, 2008

It's a Weird World

One place we thought might be a possibility is just up the road from the shop we originally wanted. Rang the agent on the sign, explained our predicament about losing the one we wanted. She then floored me by sounding surprised and saying that in fact her company was handling that shop - and has been for a couple of months, so all a bit weird that the other agent was still organising onsite inspections as late as last week. So might be some life signs after all.

We've emailed off to her copies of the Heads of Agreement we'd dicussed with the other agent, she's come back to say that she can take an expression of interest to the owner. I think the priority right now is to get our architects through so we can try and get a better grip on costs, before we commit to a formal lease offer.

Monday, May 12, 2008

Local Councils Who Help

Sunday, May 11, 2008

Signing a Contact for St Kilda

We’re organising something similar with City of Bayside for the Hampton shop. It does cost – I think Port Phillip is $150, but if you are buying a food business, or planning to establish a new one, they’ll come out onsite and provide advice and guidance. If there’s already a Food Permit they effectively are doing a formal inspection, and provide written assessments.

I reckon it’s no different to having the RACV inspect a second hand car before you buy. Foolish not to get the vehicle checked before purchase.

Saturday, May 10, 2008

All hail our business banker

All hail our business banker. Working on a Saturday doing emails, promises to resolve the problem with the loan in the wrong name. Could kiss her.

Friday, May 9, 2008

Another Offer

Thursday, May 8, 2008

What a Day...

After T we headed off to the other side of town to see a small café (well, more a sushi/burger bar) up for sale on Brunswick Street in Fitzroy. It’s dirt cheap with a listed sale price of $18,000. It’s not on the busiest part of Brunswick Street – which is already heavily over-populated with food outlets. Not for us, but interesting to see what’s out there.

Got home to find the loan documents from the bank have arrived. But big problem, the borrower’s name is wrong. It needs to be in our personal name, part of the structuring necessary to help with a CGT liability from previous business venture. They’ve got the name of the company. Talked through on the phone with our accountant who confirmed it was a problem so fired an email off to the business banker asking if it can be changed.

Then F gets an email from the agent for the Docklands premises that we really want. It’s been sold!!! “The client has informed me that the property has sold and does not know as yet if the new owner wishes to occupy or lease the shop.”

F bats a message back to say that we’re still interested if the new owner wants to lease. This is a big blow. And we’ve lost out because of the incredibly long time it’s taken to get progress, particularly the bank. I’m pretty sore about all this. We first approached the bank in February, and at the time were told it would be a 48 hour turnaround. It’s now THREE months later – and we’ve now lost the ‘jewel in the crown’ premises.

On top of all this the phone started to ring.

First up the St Kilda cafe agent rings to say our new offer (which was basically the same as February’s) is too low. Will be go another $5,000 or so? Answer = no. Another phone call. Will we split the difference? Answer = no. Another call. Agent suggests we sign a contract, write a deposit cheque, that’s a clear sign to the vendor we’re serious, and not just tyre kicking. And by going to chattels contract route we save the vendor having to cough $600+ to prepare the necessary documents. After a discussion with F call the agent back to say ok, we agree to meet on Sunday (?) to do the necessary paperwork. We’ll do it in between running around from children at cheerleading and soccer.

Next sequence of phone calls is with the owner of the premises in Hampton – the old laundry. Our opening offer not so well received. Which I guess we anticipated although we backed it up with a copy of our rental rate survey for the area. Bit of tooing and froing, but by the end of the day there’s a number floating around that might work for both parties.

All of these negotiations made all the more fun by the fact F is up at hospital with our youngest for an ophthalmology appointment, so I’m having to text and phone her every 5 minutes with the latest progress on both the Hampton and St Kilda premises, and plot the next moves.

Needed a couple of glasses of nice red wine this evening.

Wednesday, May 7, 2008

Useful Info

Tuesday, May 6, 2008

Getting Busier - But first the Architects

S and K are going to send us the standard RAIA Client and Architect Agreement. It’s a nice simple document clearly setting out what the architects will do – with checkboxes to indicate the specific services that will be included.

We talked through issues such as planning permits, dealing with council, finding a builder (indeed, whether we actually need a builder), tradies and the like.

Faxed off offer for Barkly Street – same price as we offered back in January. It just isn’t worth us spending more, we don’t want the business per se, but the location and lease, and maybe some of the equipment. Agent’s already faxed me a sale contract with blanks for the price.

Emailed off an offer letter to the owner of the old laundry in Hampton. It’s less than they are asking, but we offering a longer lease, no free months etc. I did a survey of rental rates on commercial properties in the area, and feel our offer is justified.

Restaurant and Catering Victoria emailed me some great staff and payrate information following up on my email enquiry yesterday. One of the most useful items is a simple spreadsheet outlining hourly payrates for staff at the various award levels, broken into weekdays, weekends, evenings etc. Just what we needed to help figure out staffing budgets.

Monday, May 5, 2008

Time for ABN

Fantastic call with R at the bank, re merchant services, online banking and the like. He’s ex-café industry, loads of insight. What a pleasure to deal with banking staff who have a direct connection to your industry. We could even talk the pros and cons of the various coffee suppliers. He reminded me that there are special credit card merchant rates for members of the hospitality industry associations. I’ve already got an application into Restaurant and Catering Victoria.

Friday, May 2, 2008

We're Approved - Yay

Outstanding, the bank has emailed an approval for the loan, so we’re rocking and rolling. It’s difficult talking to landlords and business brokers when at the end of the day we’re unable to take any real action. We could be spending our own money in anticipation of the bank coming through, but if there’s any problem with the loan we’d be left hanging in the breeze without enough capital to finish the job, but all our money tied up, and probably lost or significantly devalued.

Off to the inspection of the St Kilda café this afternoon. We arrived a little early (we’d come straight from a consulting job out of town) so stopped at Mr Wolf, around the corner on Inkerman Street for lunch pizza. Mr Wolf good and busy with funky people doing business and catching up. Inker7 next door also busy. The crowd is clearly there, providing you have an offering they like.

Trooped off to inspect the café in question. Pretty much as I remember from February, although F’s first time through. Equipment is ok – there’s a sandwich bar/under bench fridge we could use, and some smaller equipment. But we’d need to essentially pull everything out while we redecorate, which leads to some interesting logistics issues. It’s not a big space, but the size should be ok.

Desperately need to do something about the façade and the way the café presents to the street. It’s almost anonymous, and just not a good funnel drawing people in – indeed, it’s almost the reverse – it’s a narrow entrance and a big room. Few down at heel characters munching their all day breakfast highlight how in its current state it doesn’t have a hope to capture the affluent market downing gourmet pizza up the road at Mr Wolf.

The agent suggests we go for a chattels contract – so instead of buying the business and goodwill, we buy the assets – which includes permits etc. Have to pay GST (albeit we just get that back as a credit on the first BAS), and it saves the vendor coughing accountant/solicitor fees.

After a couple of phone calls, received fax from owner of the laundry building in Hampton that we like the look of, with barebones run down of potential lease arrangements. Rent’s a bit on the high side – I’ll do a survey of rentals in the area to try and peg a reasonable per square metre rate.

Thursday, May 1, 2008

Blast from the Past

Interesting. Had a call from the broker for a St Kilda café we looked at back in January/February. We made an offer, it was rejected as being way too low. Current owners paid twice the price a few months prior. Broker says are we interested in revisiting, and after a chat with F I said ‘sure’. Have agreed to go and inspect again tomorrow afternoon.

Sunday, April 27, 2008

Coffee Critic

Friday, April 25, 2008

Possible premises

Now there’s a sign with a phone number to call about leasing – so I rang. We could get excited about this space. It’s reasonably large, but most importantly it’s immediately adjacent to the school crossing over to the local state primary school (where our son attends). Plus round the corner from the local Catholic primary school.

All those mothers dropping children off in the morning… and we have a ready made audience of a couple of dozen – the mother’s from our son’s class. It reignites the ideas we had about school lunch bags that we first talked about when we looked at the shop on Fitzroy Street a couple of months ago, opposite St Kilda Park Primary.

Finally there’s no immediate competition. There are other cafes around, but they’re further away up and down the street. We’d own the strip in front of school (albeit shared with the next door pizza/pasta restaurant, but they’re a different proposition and only open at night).

Wednesday, April 23, 2008

Coffee Culture

Our trainer Melissa clearly has plenty of years making coffee. And it shows, starting from when we walked in and she offered us a cup of coffee. Problem is, it was perfectly made, which meant our, I suspect desultory efforts later paled into insignificance. But it set the tone – it showed she really CAN make a seriously good coffee, and gave us a benchmark we need to try and match. Melissa’s also a judge for the Australian Barista Championships.

Just a morning’s course, but full one, racing through how to prepare the machine, make a coffee, texture the milk – then clean up your machine and equipment afterwards.

Believe it or not William Angliss runs an entire full on coffee course – Prepare and Serve Espresso Coffee is a nationally accredited unit of competency, with theory and practical. There’s even a course on Milk Texturing and Coffee Art – all those pretty squiggles on the top of your latte!

It was my first time working an espresso machine in anger. And now I understand why so many people call coffee an art. It ain’t as easy as it looks. The other problem is, thanks to Melissa, I know a bunch of things many coffee makers do wrong.

There’s a whole world of coffee out there. Check out coffeesnobs.com.au for example. That’s where I discovered you can download software to your computer to monitor your coffee roasting process (you DO roast your own beans at home don’t you). You hook a thermometer to your PC, and stick it into the coffee roaster. It then monitors and reports the roasting process. Cool. Coffee Geeks, my type of people.

Wednesday, April 16, 2008

Learning how not to serve the drunks

I guess it’s a way of trying to ensure that bar staff at the all night places know when to stop pouring drinks down the throat of some suburban blow in to the CBD, who’s likely to kick up trouble once he’s had a few too many. I’m not sure the plan’s working given the highly visible problems in town in recent months.

But the RSA is in general pretty useful, and seems to me everyone serving alcohol should do it. Our trainer Rob is an ex-copper who used to run the police licencing unit in town – which means he was at the pointy end when they cleaned up King Street in the 90s. It was a good session, Rob’s a good, practical to the point sort of trainer, who uses a fount of anecdotes and knowledge to powerfully illustrate how serving alcohol irresponsibly is potentially significantly detrimentral to your business.

The afternoon session, First Step, is designed (and a requirement) for people applying for a Liquor License. It’s a quick skim over the legislation, understanding how licensing works, common offences, signage and so on. Again Rob led the group, covering plenty of ground, but still leaving time for discussions and questions.

Oh, and now I know there’s a difference between ‘intoxicated’ and ‘drunk’. Apart from three Bacardi breezers…

A long day, but well worthwhile.

Friday, March 28, 2008

Yes been quiet, no haven't abandoned ship

Plus been waiting on the bank - despite being told we'd get a decision on our finance in 48 hours it turned into more like 3 weeks, and still counting. Although we've now had a verbal 'yes', and yesterday I dropped a big packet of documents to them - tax returns, insurance policies and the like. So it does all look very promising, and hopefully we're about to rock and roll.

Been working on building up action list so we can push the button just as soon as money confirmation comes through.

Unlike the movies, it's all a reminder that real life moves much more slowly that you sometimes would like. And that's business all over, so often you are at the mercy of forces outside your control. If you think it'll take a week, in reality budget a month. On CSI DNA tests come back in 15 minutes. In the real world it's more like a week.

Best lunch in ages

Eurodore also has regular events like wine and cheese tastings. We've booked for the next one in a couple of weeks.

Saturday, March 1, 2008

Friday, February 29, 2008

Certificate of Completion

Tuesday, February 26, 2008

Chasing agents

Monday, February 25, 2008

Neat tea strainer

Saturday, February 23, 2008

Off to training

My Statement of Attainment arrived the other day for the 'Apply Basic Food Safety' course I did a few weeks ago!

Friday, February 22, 2008

Positive meeting at the bank

However, he re-iterated his intent of personally handing our application to the credit manager - if necessary he'll book a 30 minute appointment and sit down and run through the proposal in person. This is obviously significantly good - instead of our application just coming up on the credit boss' computer screen, along with dozens of others, we'll have an advocate staring him (her?) in the eye. Can't ask for more.

We're hoping for a decision next week. That would be brilliant.

Tuesday, February 19, 2008

The bank likes the idea

"I love the Powerpoint. Well Done!! This is exactly what I meant when I described it to you and the cash flows are spot on. Looks great!!"

Plus some other nice comments. We're going to tee up a meeting, hopefully for Friday.

All Hail PowerPoint

The task now is to meld these into the Power Point presentation and get it off to the bank, which we'll do today.

We've also tidied up the financials, including full fitout budgets for the two cafes, and cash flows for the first two years, showing capital requirements, operating income/expense, cash etc. I think the structure works fine - eg the relationship between the numbers, the ratios and so on. Even if the actual numbers fluctuate, the budget should retain its shape fine. The numbers show that with a couple of cafes up and running, we should be doing ok. The 4 cafes gives us the scaling benefits, and an aggregate EBIT that's pretty acceptable, providing we can hit the targets.

Here's the Power Point, albeit with the financial summaries removed. I won't post the full financials either. Perhaps there is some mystery we should maintain.

Sunday, February 17, 2008

Notes to self

- Chase agent for greenfields cafe #1 - still have not heard back from him about the key he was trying to get so we can do an inspection

- Talk to agent for existing cafe #2 - think we better put him out of his misery that we're not going to review our offer.

Key issue now is to get the bank to approve finance this coming week, so we can get on with lease negotiations. Plus hopefully get a proposal from the architects and thus continue to firm up the budget.

Thursday, February 14, 2008

Agents work all hours

I told him we weren't in a position to do anything while our daughter was in hospital.

The P&L is only of limited use. I don't know for sure, but it feels just a fraction contrived. The revenue is almost exactly the sum of three months of the admitted weekly takings. I can't quite get the rent to line up with the previously advised amount. And there's an expense line called 'tax office expense', which is pretty odd, given tax payments are balance sheet not P&L issues. Either someone doesn't understand the most basic accounting and they really are paying tax; or someone doesn't understand the most basic accounting and they've whacked an amount in to make it look like they're paying tax.

Even more curious, the 'tax office payment' doesn't make sense in context of the revenue. If it's supposed to be their GST payments then it should be approximately 10% of their GST applicable revenue. Which they've kindly documented by splitting revenue into 'sales' and 'sales non GST'. The 'tax expense' is 1/5th of the GST that would be liable based on their professed revenue. The P&L normally wouldn't of course have GST included at all, I'm only playing the numbers this way because of the 'tax office expense' line.

It's also a very small P&L - only a dozen expense lines or so. Which I always worry about. Real expense statements tend to have a bunch of lines to cover all the weird and wonderfuls that turn up in a business. Where's the good old 'miscellaneous'!

Of course there's also no staff expenses at all in the P&L. Which begs the question - how do they pay themselves? Or are they working for free? I suppose they could be waiting for end of the year to collect dividends but something tells me that we're back to the good old cash system.

Wednesday, February 13, 2008

Meeting the architects

I think they might have been a little bemused when, in response to their query about design theme, I suggested a mix of coastal, contemporary, Gaudi, plus more!

They later emailed to ask about toilet availability - always amuses me, whenever I've worked on a building project invariably the most amount of time is devoted to debating toilets. A fundamental human need remains a constant anchor around many other decisions.

S and K also quite appropriately sought to clarify the roles everyone was playing. I made it clear they would be engaged for the design and documentation. J and us would be the clients, and provide substantial input.

The rest of this week will be devoted to life other than cafes - our daughter is having open heart surgery today and will be hospital for the next week. We'll just try and do the minimum on the cafes to keep things moving along.

Postscript: Our timing was immaculate. Within 2 hours of my meeting with the architects our daughter was being prepped for surgery.

Tuesday, February 12, 2008

Software frustration

I had a copy of Home Designer tucked away (I bought it a while back to model up our lounge room during some interior renovations). I thought I might give it a try and model up the floor plan of green fields cafe #2, the one the agent sent a scale plan through for yesterday. I re-installed the software, and successfully imported the floor plan image and started to draw in the walls. Within 1 minute I was reaching for the help file. The cafe has several walls that are not nice clean right angles - the whole main room is not square. The software felt like it was 'snapping' to a grid, because I could not fine tune the wall angles, they 'clicked' from one position to the next, nothing like the fine control I needed.

Finally I found the reason in the Help - the walls only would snap around on a 7 or so degree grid. I jumped on Google, and found some others with the same problem, and a suggestion that we needed Home Designer 7.0 - which has an option to turn off the snapping. I had v6.0. So I bought and paid online for 7.0. Which took several hours to download for a 500Meg file (slow server their end presumably).

Finally 7.0 was installed, I fired up.... and hey presto, no option to turn off snapping. $US60 down the drain.

Back to Google, and finally I found some forum posts, including items from staff at the software company. Turning off snapping is only available in the Pro version ($US495 no thanks) or the Home Designer Suite 7.0 - for $US99. The 'Suite' of course is the same damn software but with a few extras thrown in.

I decided I wasn't the slight bit interested in giving this firm more money so took myself off to Harvey Norman and bought a copy of their main competition - Punch! Interior Design Suite. Three CDs and a 3Gb+ chunk of my hard drive later I was up and running.

It DOES let me fine tune walls. So I dived in and pretty soon had the basic floor plan organised. But as with my previous experience with this type of software I'm realising it ain't as easy as they like to make it look. I can see how I could spend literally days working up the design - the walls, floors etc are easy enough to position. But of course the actual textures I want aren't set up as standard. And non of the furniture is available because this is a domestic product intended for house design, not fitting out a cafe. At the end of the day almost certainly it will be easier and quicker if more expensive to simply ask the architects to work up interior visualisations.

Monday, February 11, 2008

Visuals in progress

I'm still trying to get the imagery squared off in my head. But that's possibly because we have significant distractions this week with our youngest child in hospital for heart surgery.

While on the design path, we've teed up a coffee with our friendly architect for this Wednesday. We're hoping she'll come on board - we're going to need scale technical plans for submission to the Council.

I've also excavated a neat home design program from the closet - allows you to draw scale plans, model rooms in 3D etc. It's designed basically an interior design CAD program for home use, but I'm keen to see if we can use it to create digital visualisations. One of the software's cool features is the ability to created animated 'fly throughs' - just perfect for convincing the bank manager. I have vague memories of de-installing the program in frustration after a short try at modelling our lounge room last year. I'll try and be more patient this time.

The agent for new site cafe #2 ('M') rang this morning while we were having a lunch break in the hospital garden. I told him we'd try and wrap up a decision this week, and it would be a big help if we could have scale floor plans. He kindly sent a PDF scale floor plan through. Only had a quick look, but should kick us off. I want to see if I can import the plan to the home design program and use it as a tracing template to then lay up the walls in the CAD system.

Nice cafe

http://www.wollermann.com.au/list.php?id=2063&list%5Bcat%5D=162

Like the fitout, some nice ideas, and not dissimilar to us.

Friday, February 8, 2008

Chasing the brokers

- We have made offers to purchase two existing cafes

- We are considering leasing two new shops (brand new concrete boxes)

Each of the above presents different challenges, and advantages/disadvantages. But we decided it was important to maintain concurrent strategies and investigate the possibilities of each pathway.

We faxed offers to the two brokers on Tuesday 29 Jan. Both rang that evening to say the offers would be too low (which we knew), and we responded that unless they came through with some realistic financials, we would not be reviewing our offers.

Didn't hear a thing since then. So I rang around late today. Broker #1 says owners want an amount around 2.5 times what we offered, but they won't supply any financials. Even the broker says he's told them this is a dumb position. I guess some mug might come along and buy the business, but it ain't going to be us. Pity, the location is great.

Broker #2 says the owner promised to drop P&Ls off today or tomorrow. He'll fax 'em over to us if and when they arrive.

Not very promising. Still maintain our amazement at the businesses practices prevalent in the small end of the cafe sector. When we sold our online company in 2006 we spent several months prepping the business for sale, including restructuring the corporate entities to create a 'clean' and tidy business. Much work went on documentation and so forth. We 'packaged' the business for sale as our advisors termed it. True, there was an investment required, and yes the deal size was many times larger than we're talking with these small cafes. But surely the same principles apply?

A well managed, well documented business is going to sell for a higher price, and quicker, than a poorly managed one with incomplete or unavailable documentation. These cafe owners cripple their wealth creation opportunity by taking a short term view about cash, record keeping and their attitude to potential buyers.

I've been pondering the motives. And unkind or uncharitable it might seem, for me it's all about expertise and experience. Some people make the effort to learn how to be competent in business. Some of them have a particular propensity or talent for business - and they'll fly even higher. But basic business practice is not hard. Or at least that's what I thought. I'm possibly having to change my mind. Maybe the harsh reality is there are a big bunch of people out there running businesses who you wouldn't put in charge of a race between two flies, let alone a retail outlet turning over several hundred thousand dollars a year.

If that's the truth, then there's an even scarier notion - if they're rubbish at business, just how good are their health and safety standards? Bear in mind, these people are directly responsible for your health. They sell you food, you eat the food. History is littered with an abundance of examples of poor food safety resulting in widespread illness - and death. The same people who can't manage their way out of a paperbag; who seem hell bent on avoiding selling their business (despite professing a desire to do so); who deliberately under-report their cash takings to avoid paying tax ---- are the ones making your lunch tomorrow. How's your stomach feeling now?

Prepping for the bank

- just how quickly will revenue ramp up?

- what's the theoretical maximum income we can show for each cafe whilst still legitimately supportable?

- what balance between casual and permanent staff (been hedging the bets both ways, each has advantages, casual staff much more expensive because of the 25% loading, but permanent staff need holidays, sick leave etc)

F was about ready to head hunt one of the waitresses - young, funky, terrific manner and friendly.

Visual concepts

But what was really kicking arse was black/brown timber, lime greens, some purple. Cool, contemporary, with elements of coastal. I'm also quite partial to the odd wicker lampshade.

Looking at the magazine clippings it struck me how important the idea of a large timber communal eating table is. Cafe #1 won't have the space, but #2 should have the acreage. Mix that up with a small couch/coffee table area, and half a dozen small tables and chairs, and maybe a wall bench with bar stools.

'J' as always full of innovative ideas - for example, he's heard me banging on about storage (eg, you can never have enough storage), and his suggestion is the couch area can be built as wall couches, lift the couch to up and reveal storage below. Just like on boats and in caravans. Perfect for long term bulk hiding of non-perishables.

He's now working on some simple visual concept drawings, not particularly specific to either of the two premises we're hot on, but rather an amalgam. This will give us something to add into the power point presentation for the bank. Should be able to get that off to the bank manager on Monday. It's difficult to commence any serious negotiations on the premises until we know the money's lined up.

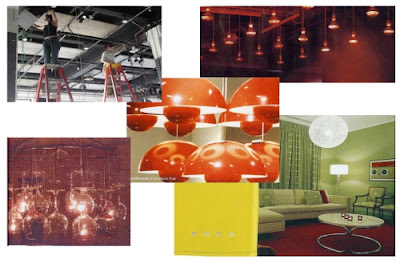

Talking to 'J' and I had something of a mind flash about how to deal with the ceiling space at cafe #2. It's a high bare concrete ceiling. I reckon we should do a lighting grid - 2inch pipe grid, just like we used to use back in my theatre days. Our favourite Melbourne restaurant Circa uses something similar. It's incredibly flexible, you just get a bunch of powerpoints at each corner, then hang all your lighting gear from the grid, using extension leads wrapped along the pipe. If you want to move a light, it's easy. Spray paint the whole thing the same colour as the ceiling paint and it'll meld in visually.

Managed to find a sort of an image that shows a lighting grid. See the black 2inch pipe grid fastened to the ceiling? Then the lights and cables hang from the grid.

And it's cheap - the pipe is low cost, you stick it together with scaffolding clamps. Major item is ensuring the pipe grid is securely fastened to the ceiling and the walls. Although in reality it won't have much weight load compared to a professional theatre environment.

Just checked the Circa web site, they have a private function room with a great limey green wall couch. Must show J.

Thursday, February 7, 2008

Punching in the dark

Notes to self for today

- Chase agent for cafe #2 premises - he's sent us a heads of agreement for the lease, and I emailed straight back querying a couple of things. One is a % of the council value of the property to go to a precinct marketing fund. Trouble is, it doesn't mention the value, so we could need to find several thousand dollars more a year in the budget

- Also want to check with him if he has any contractors for particularly the aiconditioning system install

- Chase the agents for the two existing cafe businesses we've made offers on - they've gone quiet for a week now since we faxed offers (and I told both a wouldn't consider changing the offer until I got some more detailed numbers).

Rallying the troops

How expensive is a fridge!

As with many new businesses establishments, it's scary how much things cost. And the food business is no different. Items such as display fridges, coffee machines and so on cost significant amounts of money. We'll easily drop $30,000 on the basic equipment plus some tables and chairs for the smaller of the two cafes, let alone the larger one.

You only have to look through the Trading Post, or one of the online second dealers to see that even pre-used equipment is expensive.

Which of course has a huge impact on cash flow - we have to find these enormous slabs of cash before we even open the door. We might be able to stick some of it on the credit card, and thus delay the pain for a couple of months (always have your 55 day interest free credit card in your wallet in this game), but watching a good proportion of your free cash walk out the door before you've served one customer has to hurt.

We've leased equipment lots of times before in our previous businesses - particularly computers, web servers and so on. It's a pretty established concept in the IT industry. But I was curious to see what's available in the food end of town.

Hey presto, I find Silver Chef Hospitality Equipment Funding. Very similar to the FlexiRent financial company we've used for office equipment, but these guys deal in the hospitality sector. They'll even finance a full kitchen fitout. Their pitch is good - they'll finance the equipment for 12 months, after which you can buy it (at reduced rate), return it, or finance again.

I'm liking this concept. I reckon we should budget to lease the equipment for 12 months, then make a capital expenditure allowance to buy after 12 months. Like all leasing, it'll get expensive in the longer term - hence get it off the expense sheet and onto the balance sheet once free cash allows.

Wednesday, February 6, 2008

Do we need this?

Getting head around the requirements

We're dealing with a sequence of activities that all interlock together, and which have to occur in the right order:

- In order to operate a cafe we need a Food Permit. In order to obtain a Food Permit we need to apply to the local council. For example, the City of Melbourne. Here's the pages on the City's site about Food Safety.

- In order to apply for a permit we need to have scale drawings detailing where everything will go and what it will look like.

- But first we need to convince the bank to lend us some money. We're part financing ourselves, and borrowing the rest. To win the bank over we need 'pretty' concept drawings, so their credit department can get all excited and agree to give us a big pile of dosh - preferably unsecured. Oh, and of course, capital budgets and cash flows.

- In order to do the visualisations, we need to determine which premises we want. And to do that, we need to assess that the premises will be appropriate. And to do that we need to work out in detail our..... requirements! And cost them with at least ballpark figures.

- In order to assess the appropriateness of the premises, we need to work out in detail that we comply with the requirements of the Council and the Food legislation. And only reliable way to do that is to submit preliminary plans to the Council and have them assessed.

- In order to get plans drawn we need concepts and vision. So we've got a friendly brother-in-law 'J' who's going to throw some creative juice around; then we can pass to our architect 'S' who can turn them into something the Council inspectors can interpret. But to do the concepts we need .... requirements.

Hence today's quest being trying to compile a list of requirements, which will evolve over time into a more formal specification document.

Tuesday, February 5, 2008

Inspection Cafe # 2

It's a from scratch fitout - at present just a concrete shell with fireservices hanging down from the ceiling. But all the right proportions and facilities including grease trap and vents.

Outside we'd be able to have a pretty good size seating area. The agent spoke enthusiastically about the developer's plans for the area.

Agent's sending a heads of agreement, so we'll see what the offer is. We need to be cautious - whilst there is no questioning the potential of the area, our concern is how long we'll need to wait as the foot traffic, office workers and general activity builds in the area. Suspect it'll be 12 months at least, but this would get us in on a magic spot from day one, ready to take advantage of the projected growth in the vicinity (they are still building some of the big office buildings).

Added bonus is 150 apartments above us - and we'd be right next door to the front entry. Hard to miss us.

Saturday, February 2, 2008

The nature of the cafe business

We know this for a fact - it's such an ingrained and accepted practice the business brokers representing the cafe owners even speak openly about the 'cash ratio'. One broker we're negotiating with spoke about how it would be our decision to choose a cash ratio - 50%, 60% - eg what percentage of the takings would be officially reported.

They even cover off the situation where, because the books don't reflect the true takings, a potential buyer might be nervous about paying the asking price. So they offer 'trial periods', whereby the sales contract will include a get out clause if takings don't hit a certain level.

It's not hard to pick a cafe that's under-reporting takings, the signs:

- The paperwork from the broker is minimal or non-existant (they don't want to have to provide a signed off Vendor's Statement certifying the revenue)

- If you are provided with some financials, the ratios will be off. Here's how you tell:

A cafe is advertised for sale. The ad says the takings are $4,500 a week, with 10kg of coffee being sold. The you receive the financials and they show a gross revenue for a year of $150,000 - and a cost of goods vs revenue ratio of 40%.

Start doing the maths. For a start $4,500 a week = $234,000 a year. 10kg of coffee makes around 1,200 cups of coffee, say at an average of $2.50 retail. That's $156,000 just in coffee sales alone for a year.

And cost of goods at 40%! Should be around 22-25% maximum.

When I first realised this was the situation my ethical business bones started to ache. How come the tax office doesn't start in on these people - we've run businesses for 15 years, and we've always run our accounts above board. So while we've been paying taxes, these guys have been evading taxes.

Then I considered the cash chain. Whilst the cafes can't pay cash for some products - for example, buying in drinks from major suppliers like Coca Cola, they do buy a lot of fresh food - fruit and vegetables for example. These are often distributed by small businesses - basically a bloke with a van who looks after a small group of cafes. He goes to the markets early in the morning, purchases the orders, the delivers them out to his customers, the cafes.

The cafes often pay cash to the distributor. Who in turn is quite likely paying cash to the market stall holder. And there's no tax disadvantage. Because there's no Goods and Services Tax on fresh food. So no input credits to claim for the cafe owner. Or the distributor, or the market stall owner.

Thus you get a cash driven supply chain. Some sales are reported on the books - enough to keep filing Business Activity Statements. And a decent percentage are not.

If the tax office got involved their first point of investigation would be requiring the cafe owners to hand over their cash register till rolls, and reconciling these with the BAS filings. If the cafe owners have not been careful to not ring up all their sales whilst sticky fingering cash out of the till, there will be a discrepency.

The tax office seriously does not like you mis-reporting, and evading tax. And they come down hard. They are the one creditor your NEVER piss off in business, because they'll close you without compunction. And that's what'll happen to the small cafes if they get caught. And the distributors. And the market stall holders. Only problem - big bunch of businesses will close, and people out of work.

It reminds me of the big debate during the introduction of the GST back in 1999-2000. Originally the GST was to apply to everything. But after much public outrage, the government backed off and did not impose GST on fresh food. Their argument in support of taxing fresh food was that the GST could be a powerful tool to counter the cash black market. But creating exceptions - eg fresh food - would severly compromise the effectiveness. Now I see they were right.

Friday, February 1, 2008

So here's the plan

As a variation, we may decide to lease vacant shop space instead of buying existing businesses. This has the advantage of not having to pay for an existing business, but the fitout will be pricier, and we have to build trade from zero instead of tapping into existing customers.

We reckon there are a number of opportunities we're exploring that can help us to success:

1. The vast majority of small street cafes in the Bayside area have zero brand or style. There is no individuality, theme or concept. We will create a strong branded theme and style.

2. Very poor business practices appear to be prevalent. We have now looked at nearly a dozen small café operations for sale, and all have been characterised by low quality management, reporting and systems. We will employ sophisticated small business management practices built over 15 years of successful business management.

3. The small street cafes do no marketing that we can discern. Yet they are located in high population centres, usually with major businesses and residential clusters in immediate proximity. We have long experience in creating below line highly targeted low cost marketing campaigns, and we will use this background to encourage locals to give us a try.

4. Same old same old food and beverage and/or too large or too inconsistent menu. We’ve seen cafes selling hot chips along side freshly squeezed juices; vast menus for a 10 seater café; or just a lack of imagination. We will present a consistent menu of food and drinks, with something different to capture peoples’ interest. For example, platters of high quality French and local cheeses, with good breads and biscuits with a matched glass of wine. (we plan to apply for a liquor licence for all our cafes).

5. Aggregation benefits. With poor management, zero marketing and lack of brand, small street cafes are often breakeven, with a high owner turnover as a consequence. Our plan is to have four cafes within 12 months, with superior management, strong concept and brand, and good marketing. We will achieve efficiencies and savings in back office, accounts and purchasing, yielding an improved return on investment and inevitably a better experience for the customer.

Diving in

We'll have to get up to date - we've been on the case since the new year, so we'll post a few updates to review progress to date, and some of the lessons already learnt.

As of today, we have two offers in on existing cafe businesses (which we would refit and re-brand), and are pursuing two brand new spaces (which would require complete fitouts starting from scratch).